The first home super saver scheme explained

It is a tough housing market, especially for first time home buyers. Fortunately, there are various schemes available to improve home affordability for first time home buyers.

Here, we’ll look at the First Home Super Saver (FHSS) scheme, a tool that can help you save for your home quicker and get a tax cut on first home deposit savings.

The scheme can be complex but we’re here to break it down into simple terms for you.

Key takeaways

- The First Home Super Saver (FHSS) scheme helps first-time buyers save for a home deposit using their superannuation fund.

- Eligibility requires being over 18, not having previously owned property in Australia, and intending to live in the property for at least 6 months within the first year.

- Contributions are capped at $15,000 per year and $50,000 in total, and planning ahead is necessary to maximise benefits.

- Only voluntary concessional (pre-tax) and non-concessional (post-tax) contributions are eligible; other types like employer contributions or contributions made before July 1, 2017, are not.

- The scheme’s limit increased from $30,000 to $50,000 as of July 1, 2022, with further operational improvements planned for September 20, 2024.

- Benefits include faster savings accumulation and tax advantages, while drawbacks include complexity and contribution limits.

- To access FHSS funds, one must apply for an FHSS determination via myGov, and once released, the funds must be used within 12 months for a property purchase.

- The scheme is assessed individually but can be combined by couples, and it’s separate from other government concessions.

- If a property purchase doesn’t occur, the funds must be recontributed to super or withdrawn with a 20% tax.

What is the First Home Super Saver scheme?

The First Home Super Saver scheme allows eligible individuals to use their super fund to save money for a deposit on their first home.

Eligible individuals can make voluntary contributions (before or after tax) into their superannuation to boost their savings compared to a traditional deposit account. Eligible savings can then be accessed later and used toward a home deposit.

You May Also Like: What Grants Are Available for First Home Buyers in WA?

Who is eligible for the First Home Super Saver scheme?

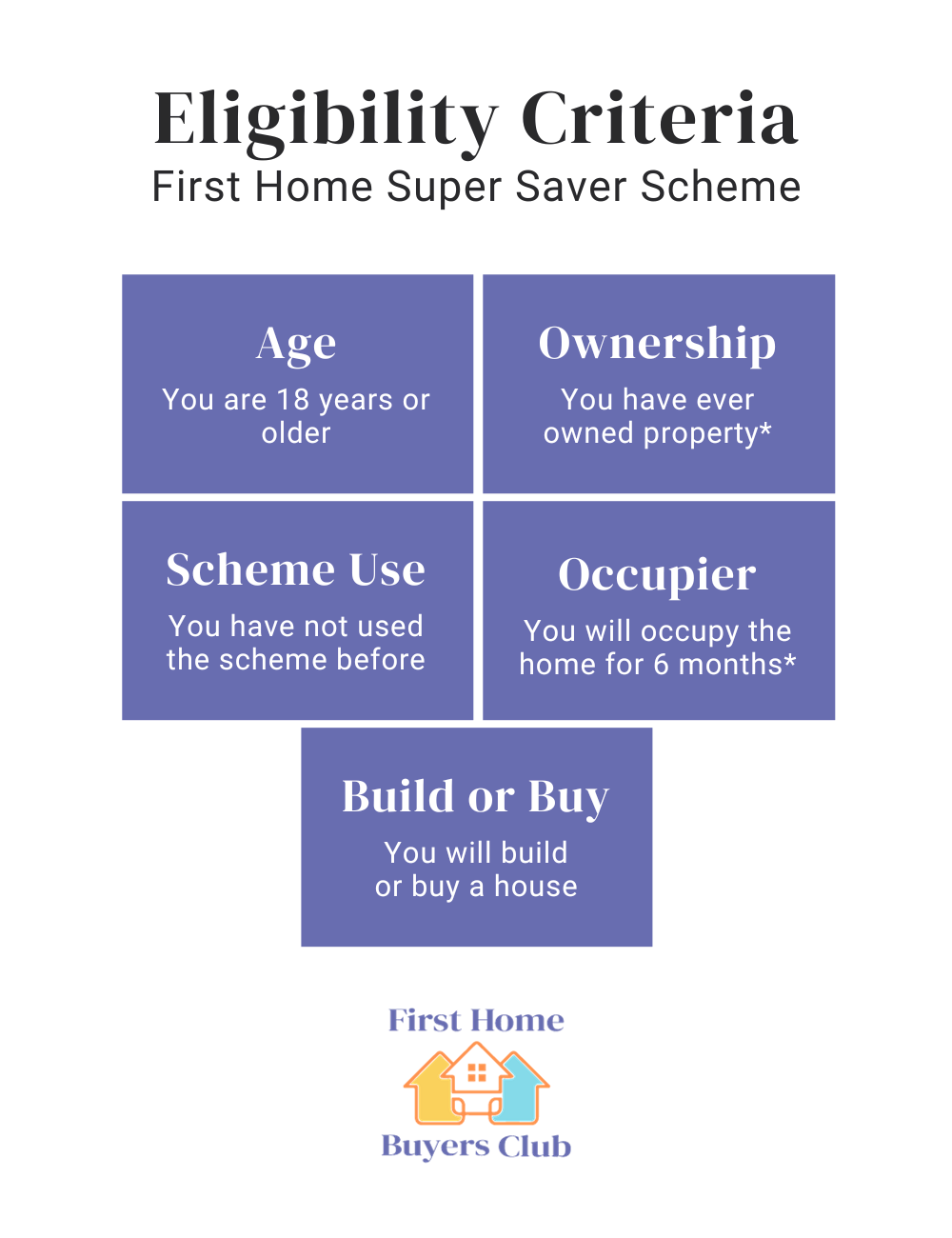

To be eligible for the First Home Super Saver Scheme, you:

- Must be 18 years or older to withdraw money under the scheme (although you can contribute to it before then)

- Must have have never owned property in Australia (this includes vacant land, investment properties, commercial property, etc.) unless you have suffered financial hardship

- Must have never used the scheme before

- Must intend to occupy the property you purchase for at least 6 months within the first year

- Must build or buy a residential property (not a motor home, houseboat, or investment property) in Australia

You May Also Like: The Essential First Home Buyers Guide

How much can you contribute to the scheme?

You can contribute a maximum of $15,000 a year and up to $50,000 in total. Because it will take several years to reach the maximum, it is best to plan ahead to get the most out of the FHSS scheme.

Eligible contributions for all years must be included in the same determination application.

Financial hardship provisions

Even if you have owned property in Australia before, you may still be eligible for the First Home Super Save Scheme if you qualify for the financial hardship provision.

Financial hardship generally refers to instances such as:

- Divorce or separation

- Bankruptcy

- Illness

- Loss of employment

If you are considering using the financial hardship provision, make sure you confirm your eligibility before you start saving.

What contributions are eligible?

The following types of contributions are eligible under the FHSS scheme:

- Voluntary concessional contributions – Salary sacrifice amounts or contributions you have claimed or intend to claim a tax deduction for

- Voluntary non-concessional contributions – Personal after-tax contributions

What contributions are ineligible?

Some funds are not eligible for release under the FHSS scheme.

The following contributions are ineligible to be released under the FHSS scheme:

- Super guarantee (SG) contributions your employer makes

- Mandated employer or member contributions that are made for you according to an industrial agreement or award

- Contributions made before 1 July 2017

- Member contributions made for you by a parent, friends, family members, or your spouse

- COVID-19 early release of superannuation re-contributions

- Contributions made under a personal injury order or structured settlement

- Amounts received from a contributions-splitting arrangement

- Government co-contributions

- Contributions made as part of small business CGT concessions

- Amounts transferred from a KiwiSaver scheme that are returning New-Zealand sourced amounts or Australian-sourced amounts

- Earnings from a foreign fund transfer you include in your receiving fund’s assessable income

- Contributions to a defined benefit interest

- Contributions to constitutionally protected funds

- Mandatory contributions under a territory or state law

- Concessional or non-concessional contributions that exceed contribution limits

It is important to ensure none of these amounts are included in your request for a FHSS determination from the Australian Taxation Office. If included in your FHSS determination request, you may face cancellation or delays.

Recent changes to the scheme

Prior to 1 July 2022, the maximum limit was $30,000. This limit was increased to $50,000.

If you requested a release of your FHSS funds before 1 July 2022, you are not eligible to make additional requests to reach the current limit of $50,000.

As of 20 September 2024, additional changes will be made to the First Home Super Saver scheme.

These changes aim to:

- Allow for greater flexibility to correct errors

- Improve the operation of the scheme

- Improve user experience when accessing the scheme

- Increase the Australian Taxation Office’s ability to amend applications

Pros and cons of the scheme

Below, we’ve outlined the First Home Super Saver scheme’s pros and cons:

Pros

- The scheme may help you save faster for a deposit on your first home through the tax-saving structure of superannuation

- You can reduce taxes since you are paying the lower super tax rather than your standard income tax (remember to take the tax you’ll pay into account when you withdraw your money)

- If eligible, couples can combine their saved amounts toward a home deposit

- You may be able to use the First Home Super Saver scheme in conjunction with other first home buyer concessions

Cons

- The first home super saver scheme can be technical and complex

- You are limited to saving a maximum of $50,000

- It requires planning in advance since you can only save up to $15,000 a year (this means it will take several years to make the most of the scheme and reach the $50,000 max)

- If you do not buy a house, you must keep the money in your super or get taxed on the released amount when you withdraw it

- If you have already signed a contract, you need to put in a request within two weeks to withdraw your savings

- Once you have gotten your FHSS money released, you have one year from the release date to sign a contract to buy or build a home

Conclusion

If you are a first time home buyer, we know how overwhelming the process can be. Even though many helpful schemes like the FHSS are available, they can be difficult to understand. That’s where our first home buyer specialists come in!

Whether you are buying or building your first home, our first home buyer home loan specialists are here to be your one-stop shop for guidance and assistance along the way.

If you want to learn more about the First Home Super Saver Scheme, our first home buyer specialists are here to help!

Get in touch with a first home buyer specialist and start your homeownership journey today

FAQs

To withdraw your voluntary contributions under your First Home Super Saver scheme, you must use your myGov account to apply with the ATO for an FHSS determination. This determination will detail how much you can withdraw.

Once you have your FHSS determination, you can apply for the release of the money to use for a house deposit. You have up to 12 months from your requested release date to sign a contract to buy or build a home.

When you contribute using pre-tax income, these are concessional contributions. When you contribute with post-tax income, these are non-concessional contributions.

It usually takes 15 to 25 days to get the money out. Once you withdraw the funds, you have one year to use them to buy or build a residential property in Australia.

You must have obtained a FHSS determination before you sign a contract to buy or build a property. In most cases, once you sign a contract to purchase, you will no longer be eligible to apply for a FHSS determination.

The FHSS is assessed on an individual basis. If eligible, multiple individuals can access the First Home Super Saver Scheme to buy the same property.

For instance, a couple could each access their $50,000 savings for a total of a $100,000 deposit.

Many individuals find the FHSS scheme incredibly helpful, especially if they are able to plan at least two or three years ahead. If you are saving for your first home, the First Home Super Saver scheme is definitely worth researching.

You can buy our build a residential property located in Australia. You also must occupy the property for at least six months within the first 12 months you own it. Investment properties are ineligible for the FHSS scheme.

No, you cannot use FHSS funds to buy vacant land. However, you can apply to withdraw FHSS funds for the construction of a home on vacant land. The vacant land cannot be purchased prior to applying for FHSS determination and the contract must be signed within 12 months of the requested release date.

Yes, you need to include the FHSS amount released to you in your payment summary in your tax return. This needs to be included on your tax return for the financial year you requested the release. Your payment summary will detail any tax withheld so this can also be included on your tax return.

Yes, the FHSS scheme is separate from other government concessions. Check with your relevant state government authority or a first home buyer specialist to confirm if you meet the eligibility criteria for other concessions.

If you do not end up signing a contract to buy or build a home, you can contribute the funds back into your super. Otherwise, you can withdraw the amount you were eligible to receive. However, this amount will be subject to a 20% FHSS tax.

First home buyer resources

- Finance, Grants

- Post by Jack Thornton

Are you looking to build or buy your first home in WA? Then it’s important...

- Finance, Grants, Tips

- Post by Jack Thornton

If you are looking to buy a home in Western Australia, you may be overwhelmed...